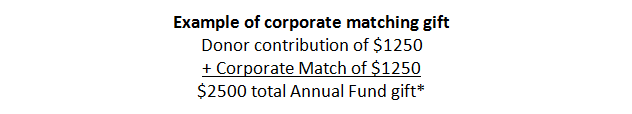

*Under the above scenario, the donor’s gift goes twice as far to serve PA and results in the donor joining our Lion Rampant Society (recognizing Annual Fund gifts of $2500 and higher) as a member of the Order of Knowledge.

If your company is eligible, contact your employee benefits department as well as Providence Academy’s Development Office to arrange the matching gift. Providence Academy’s Tax ID/Employer Identification Number is 41-1883866. If your company does not appear in the search results, contact your Human Resources department and ask if your employer offers a charitable matching gift program.

Contact Mr. Josh Anderson, Director of Development, with any questions. Mr. Anderson can be reached at (763) 258-2531 or by email.